Vietnam has emerged as a strategic manufacturing hub in Southeast Asia, attracting global attention in electronics, consumer appliances, and industrial components. Among its diverse specializations, the production of electric heating elements has gained traction as both domestic demand and export markets expand. This in-depth article provides a comprehensive overview of Vietnam’s prominent electric heating element manufacturers, their capabilities, certifications, and competitive positioning in the global supply chain.

1. Market Dynamics of Vietnam’s Heating Element Industry

The Vietnamese electronics and electrical appliance industry recorded export revenue of more than USD 114 billion in 2023, according to the General Statistics Office of Vietnam. Within this sector, electric heating elements play a vital role in household products such as kettles, coffee machines, and water heaters, as well as industrial applications like boilers, drying equipment, and HVAC systems. Global appliance brands are increasingly sourcing from Vietnam due to its trade agreements, including the EU-Vietnam Free Trade Agreement (EVFTA) and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP).

Vietnam complements traditional sourcing markets such as China by offering competitive labor costs, political stability, and tariff advantages. However, its production scale and R&D maturity are still developing compared to long-established electric heating element factory leaders in China.

2. Key Electric Heating Element Manufacturers in Vietnam

a. Rang Dong Electric Appliances

Originally recognized for lighting products, Rang Dong Electric Appliances has diversified into heating solutions, producing aluminum heating plates and tubular elements suited for commercial kitchen equipment and household devices. The company maintains ISO 9001 and ISO 14001 certifications, showcasing its integration of quality and environmental management systems.

b. Hanel Electric Co., Ltd.

Hanel is a Hanoi-based manufacturer producing industrial-grade water heating tubes, boiler heating elements, and resistance wire assemblies. The firm emphasizes export-readiness with CE and RoHS certifications, catering to both domestic appliance brands and regional industrial customers.

c. Gia Nguyen Heating Components

This medium-sized enterprise specializes in custom-designed coil heating elements for bakery ovens and drying systems. By adopting nickel-chromium alloys, Gia Nguyen focuses on enhancing thermal efficiency and durability, aligning with the requirements of commercial kitchens and laboratories.

d. Joint Ventures with Japanese and Korean Partners

Several joint ventures operate within Vietnam’s industrial parks, producing PTC heating films and aluminum convection heaters for automotive and HVAC applications. These ventures combine foreign expertise with local production capacity, helping Vietnam climb the value chain in advanced heating technologies.

3. Comparative Analysis: Vietnam vs Global Suppliers

Vietnamese manufacturers provide cost-competitive options but often operate at smaller scales compared to giants like Jinzhong Electric Heating Technology Co., Ltd. in China, which boasts an output exceeding 3 million heating elements per month and fully automated production lines. According to McKinsey’s supply chain report (2024), Vietnam is positioned as a diversification alternative rather than a direct replacement for China in high-volume components.

Global buyers often adopt a dual-sourcing strategy: leveraging Vietnam for tariff benefits and diversification, while relying on large-scale Chinese factories for stability and automation excellence. This approach reduces supply chain risk across geopolitical scenarios.

4. Certifications and Compliance

The majority of leading Vietnamese heating element producers comply with international standards, including:

- ISO 9001: Quality management

- ISO 14001: Environmental management

- CE marking: Required for exports to Europe

- RoHS compliance: Assurance of environmentally safe materials

These certifications are critical for establishing trust with multinational appliance brands. For comparison, factories such as Jinzhong in China extend further with UL, ATEX/IECEx explosion-proof certifications, and Six Sigma process management.

5. Opportunities and Challenges

Opportunities

- Preferential tariffs through EVFTA and CPTPP

- Growing domestic consumption of appliances and solar-powered heating systems

- Increasing foreign direct investment in industrial parks

Challenges

- Limited raw material production; reliance on imports of nichrome alloys and stainless steel

- Lower degree of automation compared to Chinese or European factories

- Longer product development cycles for custom heating elements

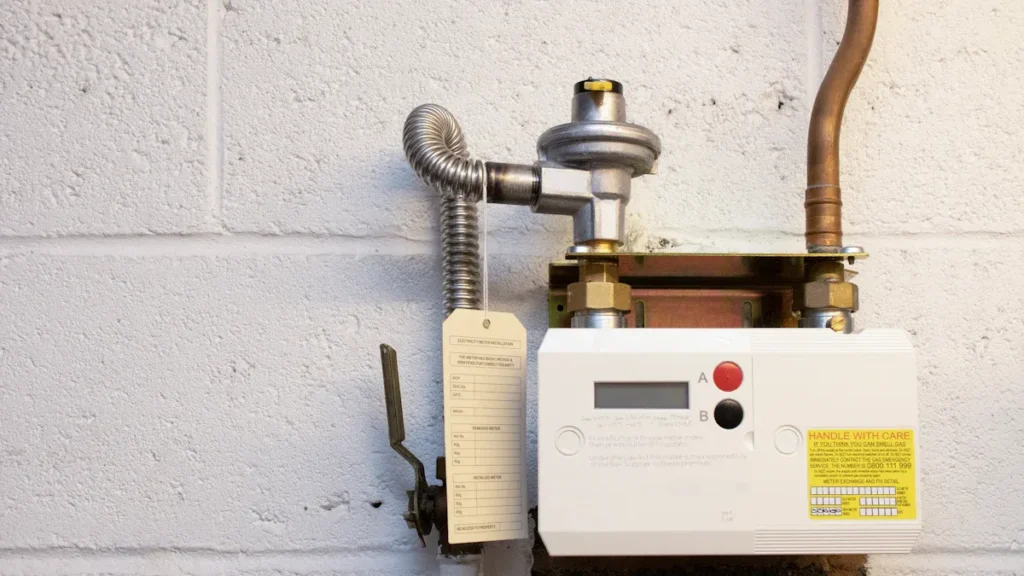

6. Case Study: Water Heating Tubes for Boilers

One of the fastest-growing export product lines in Vietnam is industrial water heating tubes. These elements, operating at voltages up to 380V, serve commercial hot water systems and industrial boiler applications. Vietnamese producers have improved efficiency by adopting stainless steel and nickel-based alloys, but large-scale industrial orders often still depend on facilities with integrated production lines abroad. Reference: Global Sources Vietnam Manufacturers Directory.

7. FAQs

Q1: What types of electric heating elements are commonly manufactured in Vietnam?

A: Typical products include water heating tubes, aluminum kettle heaters, coil elements for ovens, and PTC heating films for HVAC applications.

Q2: Do Vietnamese manufacturers provide OEM/ODM customization?

A: Yes, most major producers offer OEM/ODM services, tailoring solutions for appliances such as kettles, dryers, and industrial boilers.

Q3: Are Vietnam-made heating elements export-ready?

A: Many factories hold international certifications (ISO 9001, ISO 14001, CE, RoHS), making them eligible for global supply chains.

Q4: How do production capacities compare with China?

A: Vietnam’s factories often produce in the tens to hundreds of thousands per month, while leading Chinese facilities reach several million units monthly with highly automated lines.

8. Conclusion

Vietnam’s electric heating element manufacturing sector is gaining recognition in Asia’s industrial landscape. With advantages in cost and trade access, the nation offers viable sourcing options for global buyers looking to diversify supply chains. While it has yet to match the automation, R&D, and sheer scale of established Chinese electric heating element factory leaders, Vietnam stands as a valuable complement for companies balancing cost, quality, and geopolitical resilience. For businesses seeking tailored or mid-volume heating solutions, Vietnam is more than capable of delivering competitive products aligned with international standards.